Ship Scrapping Rates Plummet Amid Strong Market

Ship owners are holding onto older vessels rather than scrapping them, driven by significant cash flows. According to a recent report from shipbroker Xclusiv, demolition activity has shown a cyclical but declining trend over the past five years. The report highlights that 2025 is projected to be one of the lightest years for ship scrapping, with only 122 ships dismantled in the first eight months, representing just 0.38% of the global fleet.

Demolition Trends and Market Influences

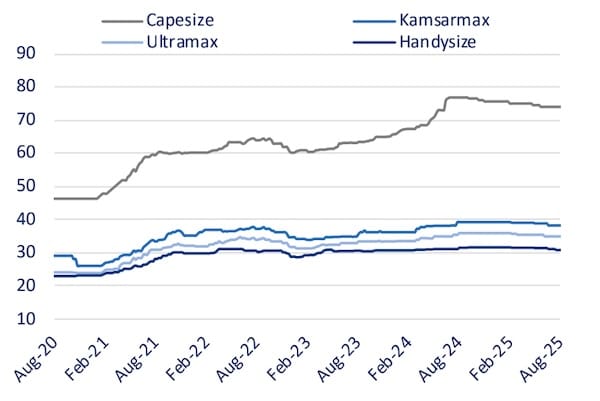

Ship scrapping has fluctuated dramatically from 2020 to 2025, influenced by freight market conditions, asset values, and regulatory pressures. The years 2020 and 2021 saw the highest scrapping rates, with 308 and 291 ships respectively. However, since then, the trend has shifted towards lower demolition numbers. In 2023, a total of 215 ships were scrapped, primarily bulk carriers and containerships, as the market adjusted following the pandemic-induced demand surge. The following year, 2024, saw a further decline to just 164 units, and the current year is on track to remain below 200 total demolitions.

By segment, the tanker market has experienced significant volatility. Scrapping dropped from 179 units in 2021 to a mere 11 in 2024, reflecting rapid changes in market sentiment. So far in 2025, 28 tankers have been scrapped, indicating a slight release of older vessels, particularly as smaller units approach or exceed 20 years of age. Bulk carriers continue to lead in demolition numbers, but the 54 units removed this year are modest compared to previous years. High secondhand values and ongoing demand for older ships are contributing to the slowdown in scrapping.

Future Outlook for Ship Demolition

Containership demolitions have sharply declined, with only eight units scrapped in 2025, a stark contrast to the 81-82 units dismantled in both 2020 and 2023. The strong performance of freight rates, particularly due to diversions in the Red Sea, has encouraged owners to retain older vessels. In contrast, scrapping of LNG carriers is on the rise, with 10 units recycled this year, driven by an influx of modern LNG tonnage that leaves older vessels without charter opportunities. Conversely, LPG scrapping remains low, with only five vessels dismantled so far in 2025, as robust trade and high fleet utilization keep older units operational.

Xclusiv concludes that the current pace of demolition reflects strong asset markets across most sectors. Owners are reluctant to scrap even obsolete ships due to favorable cash flows. However, as aging vessels continue to accumulate, a wave of recycling may be on the horizon. Should freight markets weaken or regulatory pressures increase, demolition volumes could see a significant rebound, particularly among tankers and bulk carriers. The persistence of older vessels in the market, especially in regions with lower regulatory barriers, further complicates the outlook for ship scrapping.