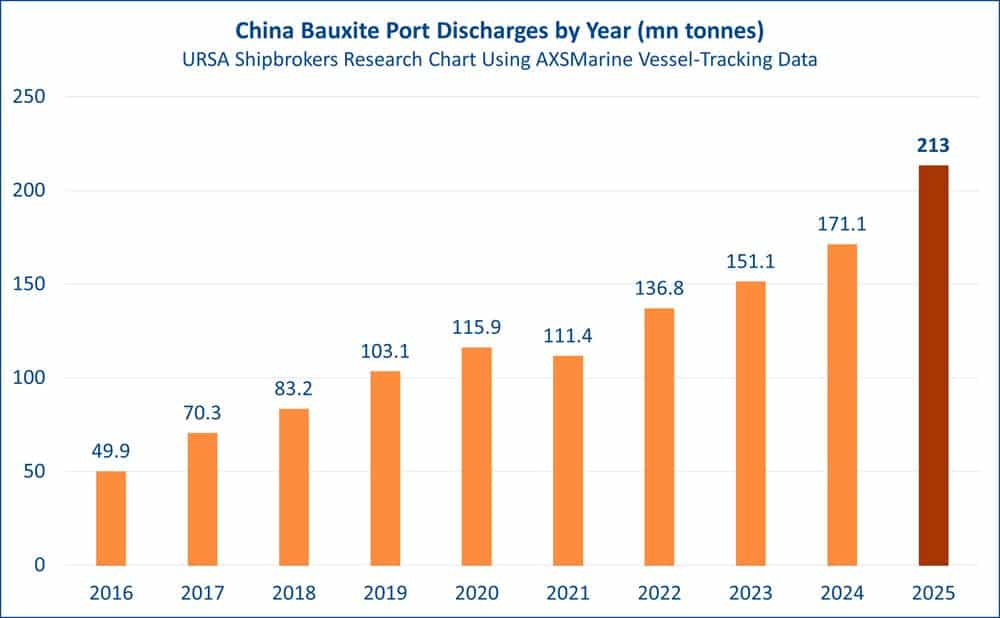

China’s Bauxite Imports Reach Record Highs in 2025

China has achieved a remarkable milestone in its bauxite imports, setting a new record of approximately 213 million tonnes in 2025. This figure represents a significant 25% increase from the 171.1 million tonnes recorded in 2024, according to vessel-tracking data from Ursa Shipbrokers. This marks the fourth consecutive year of record-breaking imports since 2022, highlighting bauxite’s role as a key driver in the dry bulk market and a rare source of demand for large bulk carriers.

The surge in Chinese bauxite demand has had a ripple effect on global markets. Worldwide bauxite discharges reached an estimated 241.4 million tonnes in 2025, reflecting a 21% year-on-year increase. Consequently, bauxite’s share of global dry bulk tonne-mile demand rose to just under 9%, up from 7% the previous year and significantly higher than the 2% share recorded a decade ago. Notably, China absorbed around 88% of all ocean-traded bauxite last year, the highest proportion seen in at least the past ten years.

Supply Dynamics and Fleet Utilization

The supply of bauxite remains heavily concentrated in West Africa, with Guinea accounting for approximately 72% of global bauxite discharges in 2025. The country supplied about three-quarters of China’s bauxite imports, with cargoes primarily loading at the ports of Kamsar and Boffa. The lengthy voyages from Kamsar to Qingdao, spanning over 11,400 nautical miles, have kept tonne-mile demand high and favored the use of larger vessels.

This dynamic has significantly influenced fleet utilization in the shipping industry. Newcastlemax vessels carried about 36% of global bauxite discharges in 2025, followed by capesize ships at 28% and post-panamax tonnage at 16%. Together, these three segments accounted for a substantial 80% share of the bauxite trade, according to Ursa Shipbrokers.

The robust demand for bauxite is underpinned by a resilient aluminium sector. China’s primary aluminium production reached record levels in 2025, with an estimated output of 40.4 million tonnes from January to November, as reported by the International Aluminium Institute. The tight supply of copper and high prices have accelerated the substitution of aluminium, maintaining strong smelter utilization rates.

Future Outlook for Bauxite and Dry Bulk Markets

Looking ahead, Signal Ocean anticipates that the strong demand for bauxite will continue into early 2026. High power costs in Europe and the United States have tightened aluminium supplies elsewhere, further reinforcing China’s reliance on imported bauxite. This trend is expected to support sustained strong flows in the first quarter of 2026.

Strong Chinese demand drives 7% y/y increase in minor ore exports

In the broader dry bulk market, bauxite stands out as a bright spot. While iron ore and coal face a softer outlook that may impact capesize demand, bauxite is projected to outperform in the near term. However, analysts have noted potential risks to seaborne volumes in the longer term, particularly concerning Guinea’s plans to expand domestic processing. Any significant impact from these developments is unlikely to materialize before the latter part of the decade.