MABUX: Bunker Prices To Keep Rising Next Week

As of the fifth week of the year, global bunker indices reported by MABUX have shown a notable increase. The 380 HSFO index rose by USD 8.78, reaching USD 423.92 per metric ton (MT), up from USD 415.14 MT the previous week. Similarly, the VLSFO index climbed by USD 8.46, surpassing the USD 500 MT mark to settle at USD 503.04 MT. The most significant increase was observed in the MGO LS index, which surged by USD 23.06, moving from USD 753.46 MT to USD 776.52 MT. This upward trend indicates a moderate recovery in the global bunker market.

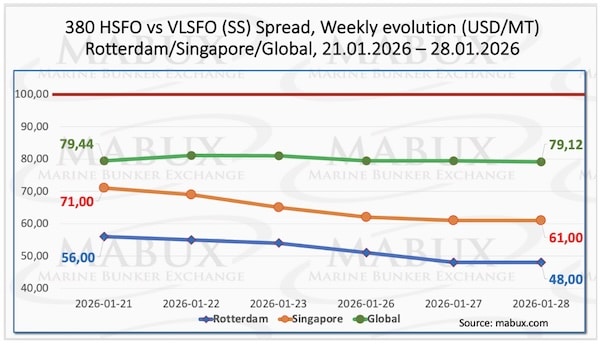

The MABUX Global Scrubber Spread (SS), which measures the price difference between 380 HSFO and VLSFO, narrowed slightly, decreasing by USD 0.32 to USD 79.12. This spread remains below the critical USD 100.00 threshold, indicating a continued preference for VLSFO over the combination of 380 HSFO and scrubber operation. In Rotterdam, the SS spread contracted by USD 8.00, dropping to USD 48.00, while in Singapore, the price differential decreased by USD 10.00 to USD 61.00. Despite the current decline in the SS spread, analysts anticipate a potential recovery in the near future.

Regional Developments in Bunker Pricing

In the Istanbul region, the ECA Spread remained stable at USD 75.00, despite earlier fluctuations that saw it peak at USD 90.00. The weekly average for this index increased by USD 20.83. Conversely, Venice experienced a decline in the ECA Spread, which fell by USD 34.00 to USD 65.00. The overall trend in both ports indicates a downward movement, with spreads consolidating between USD 75.00 and USD 65.00. This shift is attributed to rising ULSFO prices due to reduced regional supply, which has tightened market availability.

Meanwhile, the price of LNG as a bunker fuel at the port of Sines in Portugal has seen a sharp increase, rising by USD 150.00 to USD 979/MT. This surge has widened the price gap between LNG and conventional fuels, now favoring conventional fuel by USD 243. MGO LS was assessed at USD 736/MT at Sines on January 26. The MABUX Market Differential Index (MDI) indicates undervaluation across all major bunker fuel grades in key ports, including Rotterdam, Singapore, Fujairah, and Houston. This trend is expected to persist into the coming week, reflecting ongoing fluctuations in the global bunker market.

Future Outlook for LNG and Bunker Fuels

Looking ahead, Kpler forecasts that approximately 37 million tons of new LNG production capacity could come online this year, adding to the 51 million tons commissioned last year. This increase in supply is expected to exert downward pressure on prices, potentially impacting purchasing activity, particularly in China. Despite this, lower prices may stimulate demand, with Chinese LNG imports projected to rise to 73 million tons in 2026.

As of January 27, European gas storage facilities were filled to 44.23%, a decrease from the previous week. The European TTF gas benchmark has also seen an upward trend, increasing to €38.761/MWh. The ongoing dynamics in the LNG market, coupled with the anticipated increase in ULSFO supply, suggest that ECA Spread values may stabilize around the USD 100.00 level in the near future.

The global bunker market is experiencing significant fluctuations, with rising prices and varying regional trends. Stakeholders are advised to monitor these developments closely as they may impact operational costs and market strategies in the coming weeks.