Arctic Shipping Traffic Hits Record High in 2025

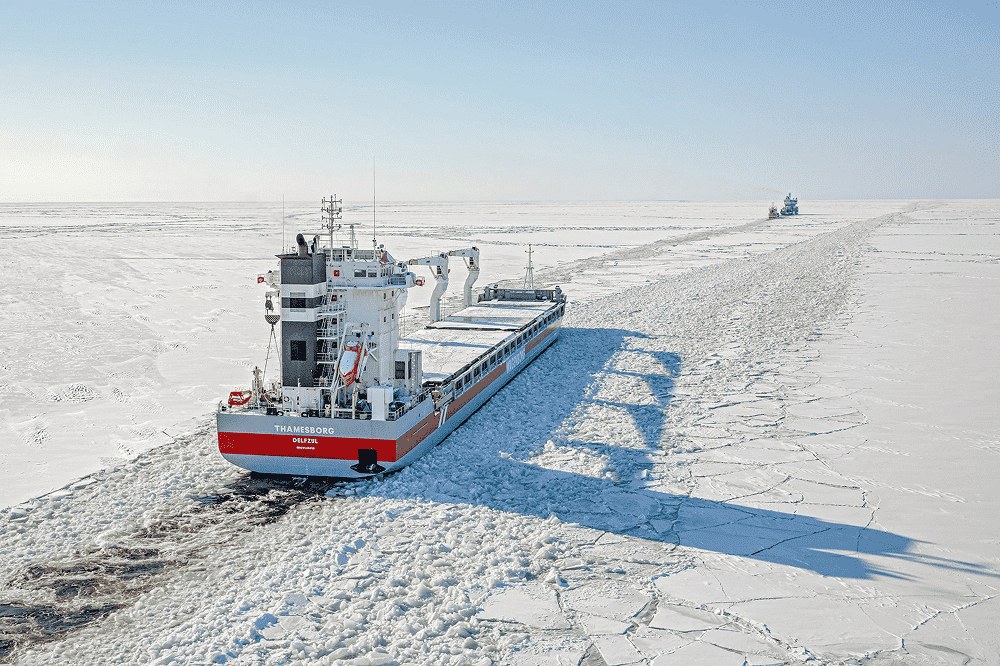

In a significant development for maritime commerce, ship traffic in the Arctic reached an unprecedented level in 2025, with 1,812 unique vessels operating within the Polar Code area. This data, released by the Arctic Council Working Group on the Protection of the Arctic Marine Environment (PAME), indicates a remarkable 40% increase since 2013, when PAME began monitoring traffic through its Arctic Ship Traffic Data (ASTD) system. The surge in shipping activity highlights the Arctic’s rapid transformation into a bustling commercial maritime zone, driven largely by expanding oil, gas, mining, and fishing operations.

The growth in Arctic shipping is not just about the number of vessels; it also reflects increased activity per ship. Total sailing distance in the region soared by 95%, rising from 6.1 million nautical miles in 2013 to 11.9 million in 2025. Vessels are making more frequent voyages, particularly along Russia’s Arctic coast and in support of mining supply chains. The peak shipping season occurs from August to October, coinciding with the annual minimum of sea ice. In September 2025 alone, PAME recorded 1,060 vessels entering the Arctic, accounting for 58% of the total annual traffic.

Dominance of Fishing and Crude Oil Tankers

Fishing vessels continue to dominate Arctic maritime activity, primarily entering from the Bering Sea and Barents Sea. General cargo ships follow as the second-largest category, transporting supplies to remote communities and supporting industrial projects like Vostok Oil and Arctic LNG 2, which have required millions of tons of construction materials since their inception in 2022.

Crude oil tankers represent the fastest-growing segment of Arctic shipping, having quadrupled in number over the past 12 years. This increase raises concerns among environmental groups, especially as some of these vessels lack ice-class protection. Additionally, liquefied natural gas (LNG) shipping has expanded significantly. Prior to late 2017, no LNG traffic was recorded in Russia’s Arctic waters. By 2025, 40 distinct LNG carriers were operating in the Polar Code area, many of which support projects like Yamal LNG. These specialized icebreaking tankers now deliver gas year-round to markets in Europe and Asia.

Wärtsilä’s Key Role in Singapore’s Next-Generation Vessel Traffic Management System

Hjalti Hreinsson, Deputy Secretary at PAME and administrator of the ASTD system, emphasized that natural resource extraction is the primary driver of this growth. He noted that, compared to other marine regions, the Arctic still has relatively few ships, meaning that even a small number of large industrial projects can significantly impact traffic statistics. For instance, Canada’s Mary River Mine, which began production in 2015, has led to a substantial increase in bulk carrier traffic into Baffin Bay, with vessels logging over 130,000 nautical miles in 2025 alone.

Despite the overall increase in Arctic shipping, traffic along Russia’s Northern Sea Route has recently plateaued. Western sanctions have complicated financing, shipbuilding, and insurance for Russian energy projects, leading to construction delays and restricted access to specialized vessels. This has slowed planned expansions, limiting growth in Russia’s Arctic basin even as global activity in the region continues to rise.