Global Bunker Fuel Market Experiences Downward Trend in 2025

The global bunker fuel market faced a challenging year in 2025, marked by a significant decline in prices across all major fuel grades. By the end of the year, the 380 HSFO Index had dropped by $132.55 per metric ton (MT), while the VLSFO Index and MGO LS Index fell by $128.27 and $43.43 per MT, respectively. This downturn follows a brief spike in prices during June, which was not sustained, leading to an overall negative performance for the year. Analysts predict that this bearish trend may continue into early 2026 unless there are notable changes in the geopolitical landscape that could affect energy supply and freight dynamics.

The decline in bunker fuel prices was consistent across all major global regions. In the 380 HSFO segment, price reductions ranged from 24% to 42%, while VLSFO prices decreased by 18% to 35%. The MGO LS segment also saw declines, albeit smaller, ranging from 5% to 16%. The only exception was in South America, where MGO LS prices increased by 7.8%. The most significant price drops were recorded in the Africa/Middle East region for both 380 HSFO and VLSFO, indicating a regional disparity in bunker fuel pricing.

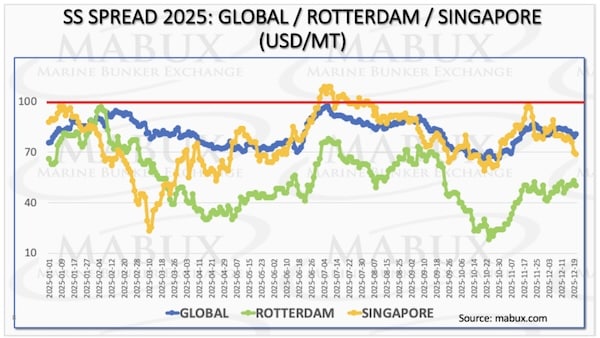

Scrubber Spread and Alternative Fuels Show Mixed Trends

The MABUX Global Scrubber Spread (SS), which measures the price difference between 380 HSFO and VLSFO, remained below the critical $100/MT threshold throughout 2025. This indicates that VLSFO is currently more economically viable than the scrubber-equipped 380 HSFO. By year-end, the Global SS fluctuated between $79 and $84/MT. In contrast, the Rotterdam SS Spread experienced a sharper decline, dropping to as low as $18-$20/MT before stabilizing around $40-$50/MT. The Singapore SS Spread showed more stability, occasionally exceeding the breakeven level but ending the year at $70-$85/MT.

Despite the low SS Spread values, the number of vessels equipped with scrubbers continues to rise. By the end of 2025, there were 6,712 scrubber-equipped vessels, up from 6,168 in 2024. This growth is primarily seen in large-tonnage segments, including bulk carriers, tankers, and container ships.

As the maritime industry seeks alternative fuels, liquefied natural gas (LNG) remains a leading option. The TTF gas index saw a significant decline in 2025, which directly impacted LNG bunker prices. By year-end, LNG prices in ARA had dropped to $638.50/MT, nearly converging with MGO LS prices. The number of LNG-powered vessels also increased, reaching 881 units in 2025, highlighting LNG’s growing acceptance in the shipping sector.

Emerging Trends in Emission Control Areas and Market Dynamics

The expansion of Emission Control Areas (ECAs) is reshaping the bunker fuel market. The Mediterranean ECA, implemented in May 2025, has led to increased volatility in the Emission Spread (ES) index, particularly in ports like Istanbul and Venice. The ES index fluctuated significantly during the initial months of implementation but has since stabilized around the $100/MT mark, favoring ULSFO as the preferred fuel in these regions.

As new ECAs are set to be introduced in the coming years, including the Canadian Arctic and the Norwegian Sea, the demand for compliant fuels such as MGO LS and ULSFO is expected to rise. This shift may lead to a gradual decline in the demand for VLSFO, which is becoming less relevant in the ECA framework.

Overall, the global bunker market remains stable, influenced by a balance of supply and demand factors. However, geopolitical tensions could lead to short-term price fluctuations. The ongoing evolution of regional bunker market segmentation, driven by stricter emission regulations and the adoption of alternative fuels, will likely shape the future landscape of the maritime fuel industry.