Riviera – News Content Hub

OSV owners in south east Asia and northern Europe are investing in energy storage systems, hybrid propulsion and alternative fuels, as engine manufacturers (OEMs) develop technologies for optimal propulsion with less harmful exhaust emissions.

Vallianz Holdings is building vessels with electric propulsion to support offshore operations as part of its growing decarbonisation programme. The Singapore-headquartered vessel owner and builder is expanding its fleet as one of the few companies investing in OSVs and azimuth stern drive tugs.

According to Vallianz head of engineering, Wu Sheng Wei, pressure for owners to reduce emissions is increasing, as regulators, banks and charterers have their own emissions reduction targets and green agendas.

For example, Saudi Aramco, a major Vallianz client, has set a net-zero target for 2050. “This means owners need to build and introduce greener vessels,” said Mr Wei, speaking at Riviera Maritime Media’s Offshore Support Journal Conference, Asia, held in Singapore, 12-13 September.

“There is an urgency in the industry to adopt decarbonising solutions”

Options to reduce emissions effectively for offshore and port vessels involve batteries, alternative fuels, or both. Mr Wei said battery-hybrid propulsion is preferred by Vallianz.

“We think battery-hybrid propulsion is the most relevant technology to us.”

Worldwide, there are about 300 vessels in operation or on order with batteries, with half of these related to offshore and port operations. “These technologies are relevant to owners and more vessels are coming online to 2025 and 2026. This trend is growing,” said Mr Wei.

Vallianz is working with SeaTech Solutions, Shift Clean Energy and ABS to build an all-electric tug to handle ships at its Indonesian shipyard. “This is part of our net-zero commitment,” said Mr Wei.

Batteries can be used to supplement power to propulsion during transit and dynamic positioning (DP), acting as a rolling reserve and peak-shaving device.

“We would put batteries on the deck to run one genset and save 25% fuel and emissions,” Mr Wei explained. “This improves operating performance and relieves crew from maintenance. We are trying to improve as a builder and operator by engineering for the transition.”

Other advantages of using batteries in port and during offshore operations include reducing underwater noise, onboard vibrations and reducing engineroom maintenance.

“After we started to apply hybrid propulsion on our vessels, we saw many advantages,” said Mr Wei. “Batteries in hybrid propulsion result in 20-30% fuel savings and emissions reductions,” he added. “There are maintenance improvements from switching off gensets. The pay-back period is three to five years.”

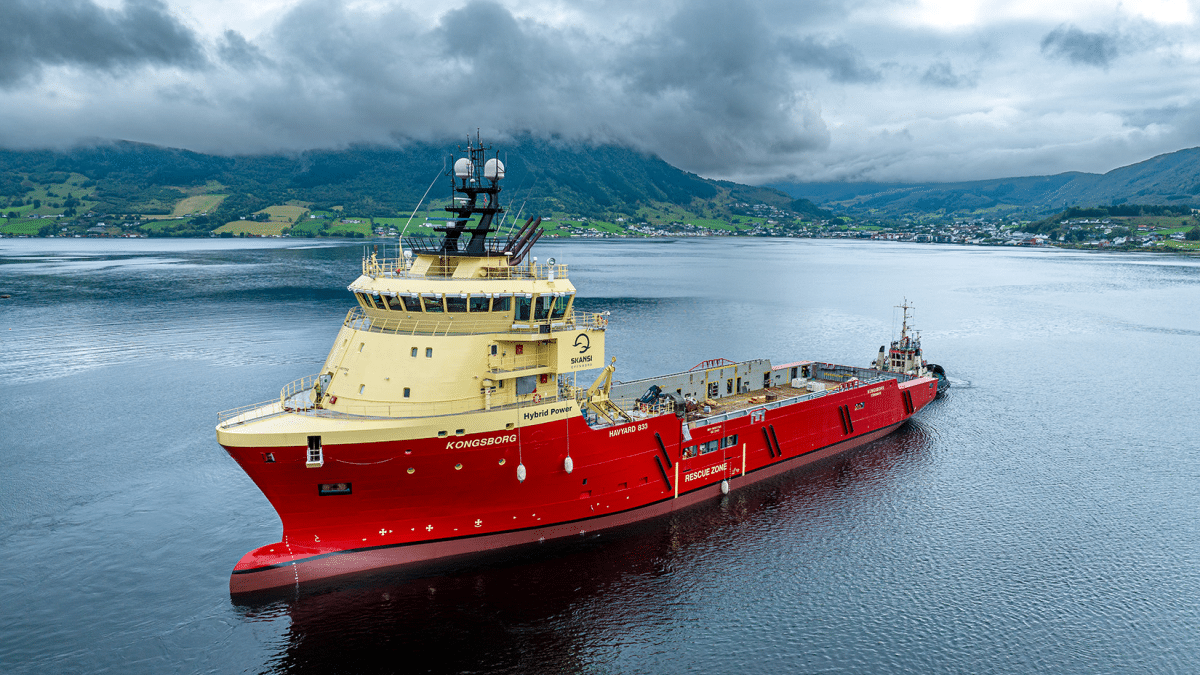

In Europe, Faroe Islands-based Skansi Offshore is collaborating with Norway headquartered SEAM to upgrade 2013-built platform supply vessel (PSV) Kongsborg with hybrid propulsion to reduce emissions during transits and DP.

During a 10-year classification docking, SEAM installed an 1,800 kVA, 620 kWh battery module in a pre-built deckhouse as part of its e-SEAMatic Blue hybrid solution.

Kongsborg is on long-term charter to Equinor in Norway, running supplies to Johan Sverdrup production complex from Dusavik, Norway, according to automatic identification system data.

SEAM anticipates 20-25% reductions in CO2 emissions during DP operations and 4-5% during transits. Batteries will also power this PSV while docked, enabling crew to undertake energy-intensive operations without firing up the generator set. This hybrid solution was interfaced with existing energy and power management and automation systems.

“We always strive to make improvements on our vessels that can lead the way for a more sustainable and greener maritime future,” said Skansi Offshore chief technical officer, Johan Sigurd Fjallsá. [“There was good collaboration] when installing the battery and hybrid solution on board Kongsborg. We are looking forward to more collaboration in the near future,” he said.

In Norway, Bourbon Horizon has signed a memorandum of understanding (MoU) with Green Ships and Amogy to construct two environmental PSVs ready for zero emissions transits.

These Norwegian-built, 82-m vessels would have Amogy’s ammonia-to-power technology and be owned by the joint venture between Bourbon Group and Horizon Maritime.

“Batteries in hybrid propulsion result in 20-30% fuel savings”

The planned ammonia tank capacity would be around 100 m3 for uninterrupted operations at sea and the power system would be contained to avoid any leaks and ensure good ventilation and adherence to DNV classification protocols. This would be the primary power source on the ePSVs, enabling zero-emissions operations.

“The successful scaling of zero-emissions technology and innovative ship design is crucial for reaching the regulatory requirements of the maritime sector,” said Bourbon Horizon managing director, Bjørn Remøy. “There is an urgency in the industry to adopt decarbonising solutions. We have joined forces with Green Ships and Amogy to launch a new generation of PSVs into the offshore market.”

OEM developments

Energy technology providers are testing engines on alternative fuels, ready to transition in the offshore sector. Wärtsilä is testing the use of methanol, ammonia and hydrogen in single and dual-fuel engines and is considering fuel cells for future propulsion options.

Wärtsilä director of decarbonisation solutions, Sanjay Verma, said the OEM was fuel-agnostic in its research approach and has tested ammonia liquid within the diesel cycle and as a gas.

“The pure ammonia engine is in the process of development, with the first ammonia engines ready for delivery [in] Q1 2024 for owner requirements,” said Mr Verma.

“Ammonia is a bad burner, so we need something that burns fast,” he explained. “It needs 10% diesel. Now we are cracking ammonia into hydrogen and blending this with ammonia, so there is only the need for a pilot fuel to get close to net zero; if we use biodiesel it would be net zero.”

Wärtsilä has been tseting hydrogen with its gas-burning engines since 2015, producing a blend of 30% to cut emissions. “Now we are testing on full hydrogen,” said Mr Verma, in gas engines. Wärtsilä is also researching how to convert methane into hydrogen and solid carbon, as a method of using natural gas as a feed stock. “There are several options for the industry, such as using biofuels or synthetic fuels, or using methane and synthetic methane, but producing synthetic fuels is difficult,” said Mr Verma.

Caterpillar is committed to methanol as a future fuel and biodiesel for current marine options. “There has been a lot of inhouse study on methanol as a choice for an easy transition over the next five to ten years,” said Caterpillar global marine strategy manager for offshore and dredging, Aditya Grover. It is developing options for retrofitting vessels and newbuildings, but Mr Grover feels more investment is needed in port bunkering infrastructure before methanol is more widely adopted.