S&P markets offering asset players ‘mouth-watering’ returns

This year might see a record in ships changing hands, with owners paying huge sums for secondhand vessels. Dry bulk carrier sales reached 37m dwt in the first seven months, nearing the 2021 record of 60.9m dwt for the entire year, according to Clarksons Research.

Ship Recycling Needs to Pick Up for Shipping to Lower Emissions

Despite the summer lull in the northern hemisphere, the sale and purchase market remains active, driven by a shortage of ships for sale rather than a lack of buyers. This scarcity keeps prices high, bolstered by extremely high newbuild prices.

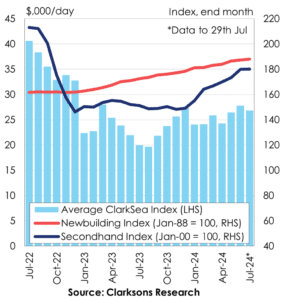

Clarksons’ recent report highlights the firm ship prices today. A 10-year-old VLCC or capesize can sell for significantly more than it would have as a five-year-old five years ago. For instance, a VLCC bought in July 2019 as a five-year-old for $71m would sell for $85m today as a 10-year-old, with additional spot earnings of $59m, totaling a 103% return. Similarly, a capesize bought for $37.5m would sell for $45m today, with an extra $27m in earnings, totaling a 91% return.

“Tanker and bulker S&P markets have been highly active, offering substantial returns,” noted Clarksons.