Dry Bulk Market: Russia’s Exit from the UN Black Sea Grain Initiative Will Have an Impact on Market

Source: Xclusiv

According to Xclusiv, “in 2023, Ukraine – despite the Russian invasion – has managed to support its grain exports and with the Sea Grain initiative active, to achieve almost 50% higher wheat exports and about 15% increased coarse grain exports compared to 2022, the year that the war started. This had a positive impact on seaborne trade, as Black Sea’s port calls were between 20 and 35 every month, keeping vessels active when almost every other kind of commodity can’t depart from Ukrainian ports. The suspension of the Black Sea Grain Initiative will mostly affect the food industry as the loss of nearly 33 million tonnes of grain that were exported the last year will and send global food prices spiralling. The Shipping industry probably won’t be affected much. Maybe there will a small turbulence within the first weeks but the global need for wheat and grains will push the market to search for alternative suppliers, something that will add tonne miles and eventually give a small boost to the vessel demand. Even if Ukraine decides to use the Danube River and transfer grain to Constanta Port in Romania, this will give a small support to the Black Sea seaborne trade, absorbing a small part of the vessels that were using the grain corridor. One must always have in mind that the water level in the Danube is getting lower day by day due to drought, so it is not possible to load barges with wheat at full capacity making the River a less attractive alternative. The main alternatives will be Canada, Russia, US, Argentina and Brazil probably leading to an increase in tonne-miles to markets in Africa, the Middle East, and Asia and eventually absorbing the hit that freight rates might have from the suspension of the grain corridor”, the shipbroker said.

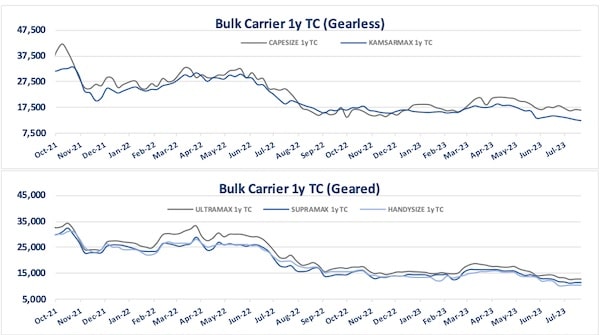

Meanwhile, “the dry bulk market hasn’t had one of its best periods so far this year, with the seven-month average of 5 main TC routes of Capesize being at USD 12,415/day, almost 32% down compared to the same period average of 2022, having highlighted the slightest decrease in contrast to other segments. Furthermore, the average for the first seven months of 5 main TC routes of Panamax is at USD 11,545/day, 53% reduction in comparison with the 2022’s TC average. The seven-month average of 10 main TC routes of Supramax and 7 main TC routed of Handysize have witnessed the greatest drop, with the former standing at USD 10,245/day, around 62% down in comparison with the 7-month average of 2022 and the latter paying less than USD 10,000/day and being at USD 9,819/day, a reduction of 61% compared to first seven-month Handysize TC average. The reason that the TC average of Capesize has fared better that the other vessel sizes might be China and its coal imports. More specifically, during the first six months of 2023, China has imported a total of around 172 million tonnes of coal (coking and steam).

Source: Xclusiv

This amount is almost 79% higher than the 96 million tonnes of the first half of 2022 and about 25% higher than the second half of 2022. Going further back to the end of June 2021, China had imported 118 million tonnes of Coal, almost 30% lower than the same period of 2023. Seaborne imports of Steam coal had the most significant increase as in 2023 China imported about 148 million tonnes, almost double the amount comparing the seaborne imports of January-June 2022 and about 50% higher comparing to the first half of 2021. China’s seaborne coal imports increase may keep its pace during the second half of 2023, as the simultaneous heat waves hit China push the country to burn more coal to maintain a stable electricity supply for air-conditioning. That increase in coal imports may create a support for the dry bulk market, so as to the freight rates to remain to at least to current levels”, Xclusiv concluded.

Nikos Roussanoglou, Hellenic Shipping News Worldwide