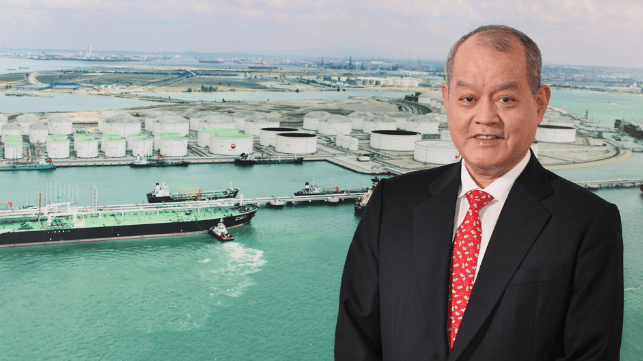

Singaporean Bunker Magnate OK Lim Sentenced to 17 Years for Fraud

Singapore Oil Tycoon OK Lim Sentenced to 17.5 Years for Multi-Billion Dollar Fraud

Singapore Bunker Trader Sentenced for Fraud

OK Lim, an 82-year-old well-known oil trader from Singapore, has been sentenced to 17.5 years in prison. Lim’s punishment comes after he was found guilty of an accounting scandal that caused his creditors to lose billions of dollars. His company, Hin Leong Trading Pte Ltd, once a major player in the oil business, is now bankrupt.

Years of Secret Losses Uncovered

For many years, Hin Leong Trading was secretly losing money, but Lim kept the losses hidden. He did this by borrowing extra money from banks, using the same oil shipments as security multiple times. Lim also told one of his senior staff members to create fake sales orders. These fake documents helped the company get extra loans and credit from banks. The fraud went unnoticed until 2020 when a risky business deal failed, causing the entire scheme to collapse.

Xeneta Summit: Ocean Shipping Industry Must Invest And Build Partnerships To Reduce Carbon

Serious Charges Lead to Conviction

Lim faced 130 charges, which included forgery, cheating, and conspiracy. He was accused of faking important documents and tricking banks into lending money. Although he claimed he had handed over most decisions to his staff because of his age, he still owned 75% of the company. In May, the court focused on two specific incidents involving fraud with HSBC. Lim was found guilty on three charges of cheating and forgery.

Harsh Sentence as a Warning to Others

On Monday, Judge Toh Han Li gave Lim a 17.5-year prison sentence, saying it was meant to serve as a warning to others who might think about doing something similar. Lim’s health problems were not taken into consideration when deciding the length of his sentence.

Appeals and Ongoing Legal Battles

Lim’s lawyers have already appealed the decision, so he won’t go to prison until the appeal process is over. Meanwhile, his company is in ruins, and creditors are trying to recover their lost money. In 2021, a Singapore court allowed the freezing of Lim’s and his family’s assets. The freeze covered up to $3.5 billion, which matched the amount owed to the creditors. Lim and his children agreed to pay this sum without admitting guilt, but they did not have enough money and filed for bankruptcy.

A Rise and Fall in the Oil Industry

OK Lim’s story is a classic tale of a rise to wealth and a dramatic fall from grace. He started from humble beginnings and became a leading figure in Singapore’s oil trading industry. His company owned a fleet of bunker tankers and storage terminals, making him a respected name in the business. Despite the scandal, some in the industry remember him for his early success.

John Driscoll, a seasoned oil trader, told Bloomberg, “While he has to face up to his wrongdoings and the collapse of his company, it doesn’t take away from the man’s legacy and the rags-to-riches story of what was once the country’s leading oil merchant.”